Forex Hedging

Forex Hedging for Importers & Exporters

Protect Your Business from Currency Fluctuations

In today’s global economy, importers and exporters face constant exposure to currency volatility. Fluctuations in foreign exchange (Forex) rates can significantly impact profit margins, pricing, and overall financial stability. Forex hedging is a strategic approach that helps businesses mitigate risks and secure predictable cash flows.

What is Forex Hedging?

Forex hedging involves using financial instruments to protect against unfavourable currency movements. By implementing effective hedging strategies, businesses can lock in exchange rates, reduce uncertainty, and manage potential losses.

Why Forex Hedging is Essential for Importers & Exporters

Protects Profit Margins:

Prevents unexpected currency movements from eroding profits.Enhances Financial Planning:

Provides stability and predictability in cash flows.Reduces Transaction Costs:

Minimizes exposure to high exchange rate fluctuations.Boosts Competitive Advantage:

Allows businesses to offer stable pricing to customers.

How We Can Help

- At CapitN Bulls, we provide tailored Forex hedging solutions to help importers and exporters manage currency risk efficiently. Our expert Forex analyst analyse market trends and book forward contracts with directly the Bombay treasury Banks

- This helps our clients to avoid unnecessary bank charges & expenses.

Don’t let currency fluctuations affect your business. Contact us today to learn more about how Forex hedging can safeguard your international trade operations.

How Can We Help

SERVICES

✅ Treasury Advisory and Risk Management Services:

Our senior advisors give guidance on day-to-day Forex Advisory on call and WhatsApp along with competitive Hedging Strategies on FEX exposures. A guidance on the direction of USD/INR and other major/minor currencies against INR and crosses, for Short Term and Long Term as also Intra-day basis to hedge/convert receivables/payables. We also try to fetch details on buyers and sellers through our contacts in the market to judge the direction, particularly on intra-day basis. There is guidance on RBI/FEMA/GoI circulars and amendments as and when announced along with its impact on the movement of currencies. The important aspect is to protect the costing of the exposure with stop-loss to negate any adverse impact. International events with their impact is fully taken care of while judging the impact on the currency movement.

✅ Bank Liasoning and FX Outsourcing Service:

We manage and monitor the FX exposures of SME clients by doing deals with Banks dealing rooms on behalf of our clients for hedging and send the necessary confirmation to the company/firm through mail/phone. We ensure that the rates are competitive for each transaction done for Spot and Forwards. We calculate the forward booking and cancellation charges like Swap Points, Cash Outlay charges that could be applicable in case of early/late delivery. We also try to reduce charges/margins taken by banks so that costing is reduced further.

✅ Treasury Audit Services:

Funding Strategies – Interest Rate arbitrage opportunities of funding PCFC, RPC, RTL - ECB, Cash Credit - FCNR (B), Buyers Credit/Suppliers Credit are explored. Evaluation of Sanctioned Letters and Bank Debit Advices are done. Also Evaluation of Bank Charges related to Forex Transactions, Banking consulting and Negotiations on limits, Margins and other Treasury related charges, total Banking Cost of Export/Import transactions are done. Bank Negotiations meeting, Letter writing, Joint Telephonic calls are all undertaken.

📚 Exim/FEMA Regulatory Help Desk:

We provide retainership services and consultancy on a day-to-day basis on matters which require interpretation on FEMA, RBI, DGFT, FTP, FTA, PLI Acts, Rules, Regulations, Master Circulars, and other allied acts. No execution work is undertaken with DGFT, Ministry, Bank, RBI, or any Government Agency/Officials. These are purely advisory-based services. Also, Advisory services related to DGFT, RoDTEP, FTA, FTP, and Custom Regulations are given. Support is given on Export/Import transactions like EDPMS/IDPMS issues. We also draft letters to Bank/RBI for any type of trade issues like GR waiver/Write-Off etc. We also handle cases that require approval of RBI. We provide assistance in setting up of EOUs, STPI, SEZs, and SEZ Units. Customized Corporate Training programmes on EXIM/FEMA Rupee movement etc., are done on a chargeable basis.

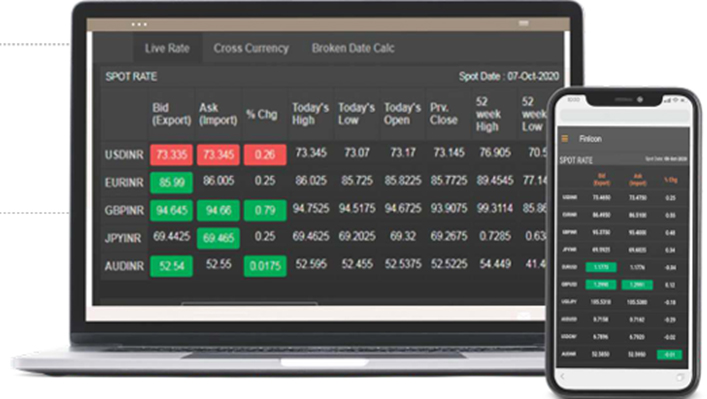

📊 Research

- FX Research Reports on Email: Daily / Monthly and Quarterly

- Fundamental and Technical Analysis

- Intra Day Rate alerts on Mobile: SMS / WhatsApp

- Great Graphic of day and Economic Data updates

💼 Buy–Sell Scrips RoDTEP/ROSCTL

- Buy or Sell Duty Credit Scrips - RoDTEP/ROSCTL service for our clients at best competitive rates

- Immediate deal closures and payment realisation to exporters within minutes

- Technical Guidance/supports on scrips issuance

- For importers - immediate availability as per desired values for import duty payment utilising Duty Credit scrips - RoDTEP/ROSCTL

📞 +91 9643882281

💱 FX–TRAVELER

- Send Money online from the comfort of your office/home at reasonable prices in a few easy steps.

- Choose from a variety of products like:

- Buy or Sell Foreign Currency Online

- Buy or Reload/Unload Forex Card

- Transfer Money abroad

- Choose from more than 35 currencies including US Dollars/Pound/Euro etc.

📞 +91 9643882281

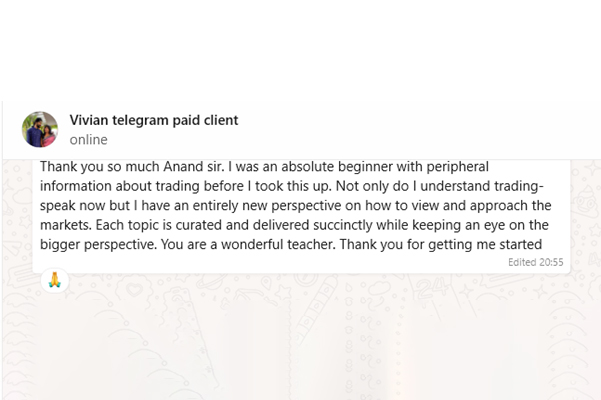

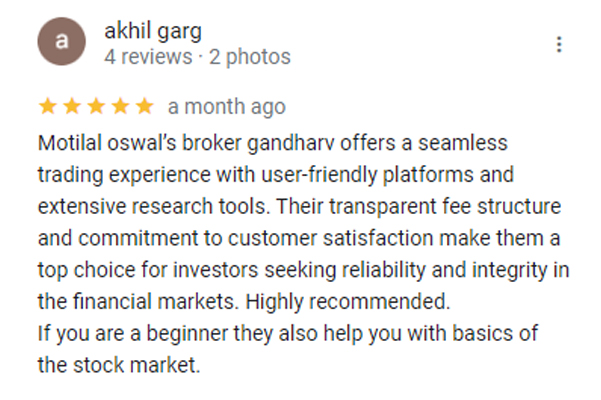

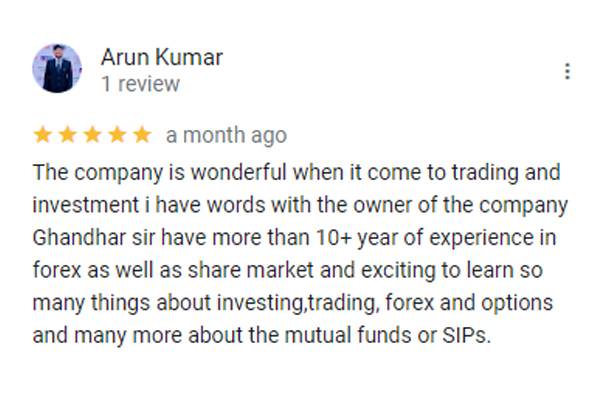

What our members say about us