Research 360 is a one-stop solution for traders and investors alike. From Equity to F&O, it caters to all with research-backed insights. Built on Motilal Oswal's legacy of research excellence, it provides access to premium research & advice, with no requirement to open a new demat account.

Research and Advisory

Research and Advisory

Picking for you from a universe of 6000+ listed stocks

Most people do not know this, but Motilal Oswal entered the finance industry as research advisory and later stepped in as a full-fledged broker. Several resources are available to help investors make informed decisions about which stocks to buy, including financial advisors and robo-advisors. Research 360 is a unique platform designed to provide traders and investors with all of the information and data they need to make well-informed trading and investment decisions. From detailed market views and comprehensive stock analysis to fundamental and technical research and advice, the platform is a one-stop solution for stock market research. With a dedicated desk for equity, derivatives, commodity & currency along with combined Techno – Funda analysis by CapitN Bulls, our advisory and research services aim to generate alpha for our members.

Why Choose Us?

-

Expert Insights

Our team comprises industry specialists with deep market knowledge. -

Data-Driven Approach

We leverage cutting-edge tools and methodologies for accuracy. -

Actionable Recommendations

Our reports go beyond data, offering clear, strategic guidance. -

Confidentiality & Integrity

We ensure complete discretion and trust in our research processes.

Whether you’re expanding into new markets, evaluating investment opportunities, or refining your business strategy, our Research & Advisory team delivers the insights you need to stay ahead.

Get in Touch to learn how we can support your business.

Our Research And Advisory Includes

Personal Financial Planning

We work with individuals to create customized financial plans that align with their goals, whether it’s retirement planning, saving for education, or wealth accumulation. Our holistic approach ensures all aspects of your financial life are considered.

Business Financial Advisory

For businesses, we offer strategic financial consulting services, including cash flow management, budgeting, and financial forecasting. Our goal is to enhance your business’s financial health and drive sustainable growth.

Investment Strategy Development

Our team helps you develop a robust investment strategy tailored to your risk tolerance and financial objectives. We analyze market trends and provide insights to help you make informed investment decisions.

Risk Management Solutions

We assess your financial vulnerabilities and develop risk management strategies to protect your assets. Our comprehensive approach helps you prepare for uncertainties and safeguard your financial future.

Frequently Asked Questions

-

What is Research 360?

-

How does the stock market or share market work?

As the name implies, the stock market or the share market is a platform where stocks and shares of companies are freely traded between investors. In India, the stock market is electronic, which means that buying or selling a company's shares must be done online through a trading portal of a stockbroker. There are currently two stock exchanges - the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) - that facilitate the trading of shares in the country.

-

How would you choose a stock for your portfolio?

There are several factors that you need to consider when selecting a stock for your investment portfolio. This includes your investment goals, your risk tolerance, fundamental factors, stock technicals, business risk factors, economic trends and market conditions, among others.

-

What instruments are traded in stock markets?

In addition to equity shares of companies, several other instruments are traded in the stock markets. Preference shares, Differential Voting Rights (DVR) shares, debt securities like bonds and debentures, derivative contracts like futures and options, and Exchange Traded Funds (ETFs) are the other instruments that are routinely traded.

-

What are the factors that determine the price of the stock?

The price of a stock is determined by a variety of different micro and macro factors. Some of the most important factors are the company’s performance, earnings reports, industry risks, market conditions, macroeconomic factors, geopolitical scenarios, corporate actions, company-specific news and events and investor sentiment, among others.

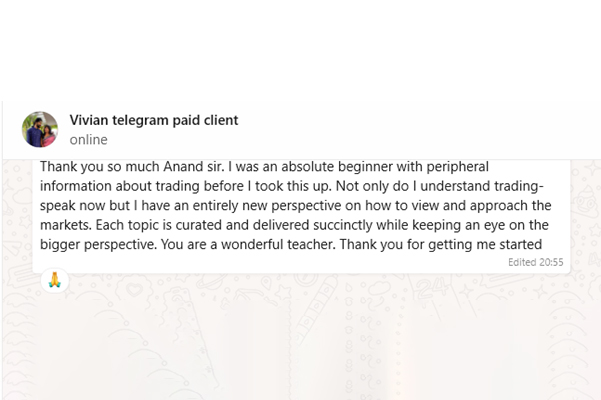

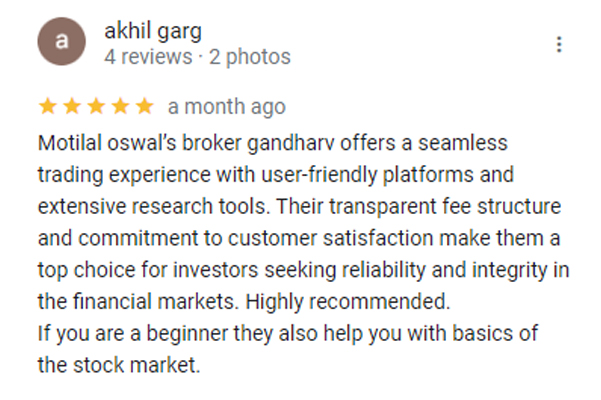

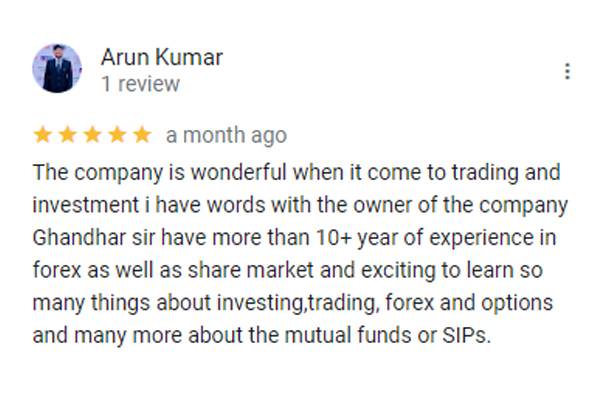

What our members say about us